Tips for Helping Teenagers and Beginners Understand the Stock Market

This post may contain affiliate links, view our disclosure policy for details.

Teaching kids and teenagers about money can be a difficult experience and we very often forget to guide them when it comes to investments and the stock market. Below are some beginner resources and tips (plus great investment apps!) when diving into the complicated world of stocks.

I was very fortunate and grew up with a parent who was extremely strong in teaching me about money and finances. Perhaps my personality had a lot to do with it as well, but kids are NEVER too young to start learning about money. In fact, the younger they are the better! I’m not saying throw money at them but they NEED to learn what happens when they don’t have money and how to carefully choose where they do want to spend their money.

I am a firm believer that kids don’t just all of a sudden turn 20 and become these perfectly independent people with strong financial sense. It takes work over many years to teach them.

As a teenager I had (with careful parental supervision) my own checkbook, my own credit card, my phone flip phone (ahhh those were the days) and my own job to pay for all of it. I bought my own clothes and paid for just about anything else I wanted. I was the epitome of independence. I didn’t have tons of money but I worked my butt off (12 hours a day every summer!) and was careful with every penny I spent.

It can be a very difficult lesson to teach, especially with kids who just don’t seem to have a grasp on saving or budgets!

One of the things I didn’t learn very much about though was investing. Besides, 20 years ago that was a complicated thing to get involved in. I KNEW investing was good, I’d heard all about retirement, stocks, CD’s, the money market, etc. but I didn’t have any good resources to learn about all of that.

Especially without enough money to go to a financial planner and learn. But today thanks to technology and that good ole’ world wide web there are a TON of resources out there. And not all of them are great.

I read this article a while ago and I was absolutely FLOORED. You guys – totally knocked out FLOORED.

Young Americans with just $1 saved for retirement are ahead of the pack.

Let that sink in. $1 you guys. I’d bet that almost, if not, 100% of us could produce $1 if we really needed to. And yet 48% of all Americans aged 18 to 30 have zero in retirement savings. Nada. This is terrifying! Before you get upset and declare money is tight – I TOTALLY AGREE WITH YOU!

We’ve been there and still have ups and downs when it comes to income. We are concerned about how little we feel like we can save for retirement just like most of you.

We had one year we couldn’t afford laundromats and didn’t have a washer/dryer so I HAND WASHED everything. That was awful when I was working at a restaurant – smelly and stiff clothes, not to mention it killed my back! We had one month where we literally only bought rice to eat. Do you know how much that sucks eating rice for breakfast, lunch and dinner? I don’t recommend it at all.

Our Christmas one year was literally going to the grocery store and buying each other a snack that we knew we wouldn’t normally buy because it was too expensive. No sympathy needed here but I just wanted to relate that I totally get it. We’re not rolling in the dough and I’m betting you aren’t either. Thankfully we pay our bills and get by but some months are tougher than others.

Stock markets and investing are something that teenagers should be introduced to and walked through as much as possible (on top of everything else that comes with the teen years!). Even if you don’t allow them to buy stocks they should be aware of how it works. I am absolutely in no way an expert on the topic of stock markets but I have dabbled here and there over the years.

In a strictly controlled atmosphere it’s a fantastic opportunity for teenagers and young adults to put their pulse on the economy and learn how the stock market works. As my kids gets older I will be teaching them too.

Ways to Invest in Stocks:

- Long Term Investment – This is of course the safest way to “use” the stock market and many retirement funds are built into this method. Look at track records, company finances, and future trends for starters. Let your kids listen in on a company stock holder meeting!

- Day Trading – Day trading is very popular but is also a huge gamble and risk. It can certainly pay off for some quick money but you can lose big money just as easily.

- Brands You Love – This is one method you can point your kids to for starters to get their feet wet. Have them choose 10 or 20 brands they love, create a chart to monitor the stock prices every day, and focus on them in your research. It may not be the greatest for long term investing but there are certainly arguments for this method of investing.

Safe Stock Market/Investing Apps to Download:

There are several different companies that offer free trading with no fees. Many you can sign up for and get free stock.

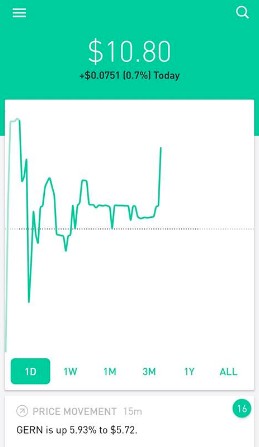

Webull – Webull is a very popular app option for trading stocks due to it’s extended market hours. It’s interface offers more features than Robinhood but it’s not as beginner-friendly to navigate.

Robinhood – Robinhood is probably the most beginner-friendly option, but has recently gotten a lot of kick back due to it’s mis-use of throttling the stock market to its favor. You can do more research just by googling “Gamestop stock Robinhood” and do your due diligence there.

Fidelity – Fidelity is another popular app from those who have already dipped their toes into the market.

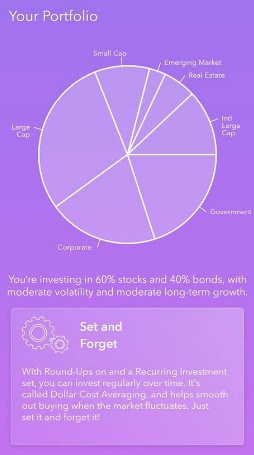

Acorns – I also use Acorns and this app allows you to save your “spare change” automatically so that you can build up funds for investing. Once it’s free “trial” is over they charge $1/month. It’s like a checking account with a debit card that allows you to control automated savings. It can be as little as $5 each month!

You can round up to the next dollar of savings on your debit purchases and even your online bill payments and then re-invest those in a portfolio based on your age / reason for investing. When you sign up here they will give you $5 to start investing too! They’ll calculate your savings with projected earnings which I love seeing, although with anything in investments, it’s never a guarantee. This app is a game changer for savings.

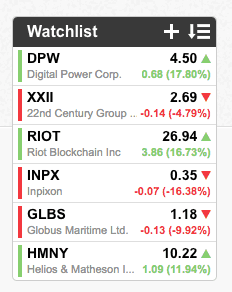

StockTwits – Although I monitor StockTwits from a computer they do have a mobile app you can download. I’m sure there are many places out there to join in a stock related forums and live feeds but StockTwits is what I discovered and liked so I stuck with it. This is basically a live feed that people are on 24/7 monitoring and chatting about stock prices as they rise and fall. It’s a great place to discover new stocks and see what’s currently trending on the market. Many of these folks are day traders.

This is a watch list I created in StockTwits. You’ll see that green means a stock is up and red means a stock is down. Every stock has an abbreviation for each brand such as KO for Coca-Cola Co, DIS for Walt Disney Co, SBUX for Starbucks, etc.

**NOTE – both of the apps will require sensitive personal and banking information as you DO have to include your investments in your taxes each year required by the federal government. I personally use both of these apps in my investing/saving strategy. As with anything do your own research before making decisions.

Stock-Related Terms to Know:

Day Trading – This is essentially buying and selling stocks the same day

Buy the Dip – This is primarily a day trading term referring to buying stocks when the market dips low.

Bearish – This is a term used for describing stocks that you feel are falling.

Bullish – This is a term used for describing stocks that you feel are rising.

Penny stocks – These are stocks that are valued at less than $1. They can be extremely volatile and a risky investment. A small handful can spike up but many can also lose you money.

Tips & Things to Know about the Stock Market:

*Unless you’re using Robinhood or some other explicitly “free trade” company, buying and selling/trading stocks comes with fees! You NEED to know this before making a purchase!

*You CAN lose your money! And it happens a lot! But you can also “win big”. This is where a TON of research comes in to play, and even then sometimes you can make the wrong choice. Do NOT put all of your money into stocks – ever!

*Create a watch list of stocks online or hand write your own tracking sheet in a notebook. Keep track of daily stock prices, buy AND sell prices, and dates of your purchases/sales.

*Different business quarters tend to have different highs and lows. This makes for an investing research pattern in economics.

*You have to pay taxes on stock profits! This is another area of finances to learn that can get complicated. At the end of the year you will need to send a tax document (usually provided from the company you are using for investment) to include in filing your taxes!

Do you have any great resources for introducing investments or the stock market to teenagers or young adults? Leave a comment and let us know about it!

|

|

|

|