Money Confident Kids Magazine & Financial Literacy Resources

This post may contain affiliate links, view our disclosure policy for details.

This is a sponsored conversation written by me on behalf of T.Rowe Price and Scholastic. The opinions and text are all mine.

One of the most important things that I learned growing up was how to handle money. It’s because of that I’m very passionate about teaching kids how to properly spend (and save!) their money as well as how to plan for future expenses and investments. But today’s generation faces very different battles when it comes to finances than I did growing up! From constantly changing (and often times expensive!) technology, apps for shopping anywhere you are, instant access to bank accounts on the go, cyber hackers, student loans, and all sorts of other hurdles to navigate through – kids today have a very different view (and access!) to money.

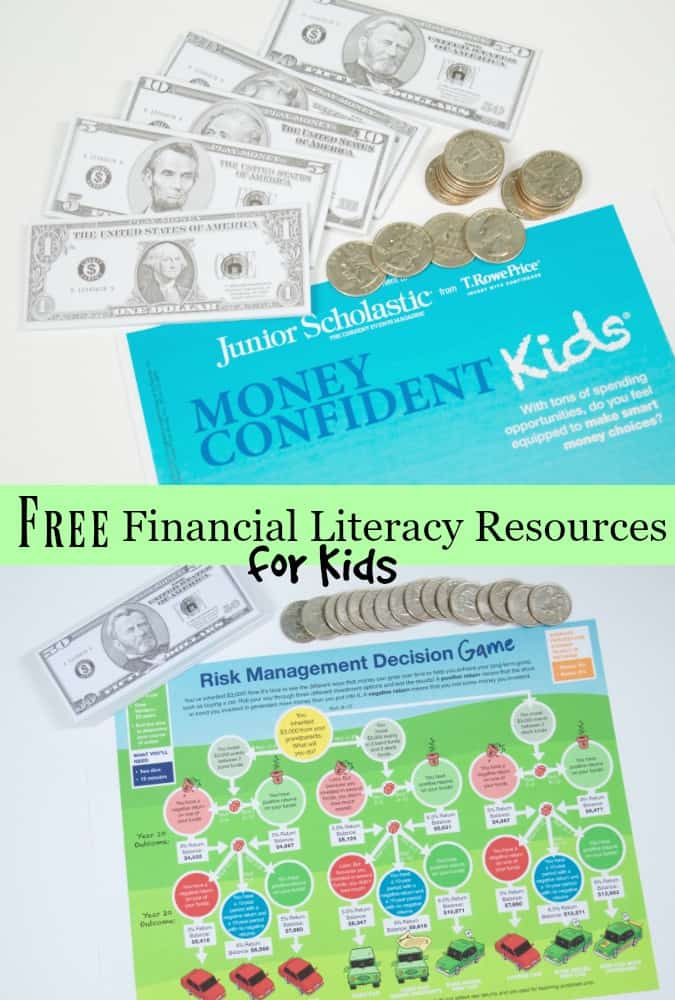

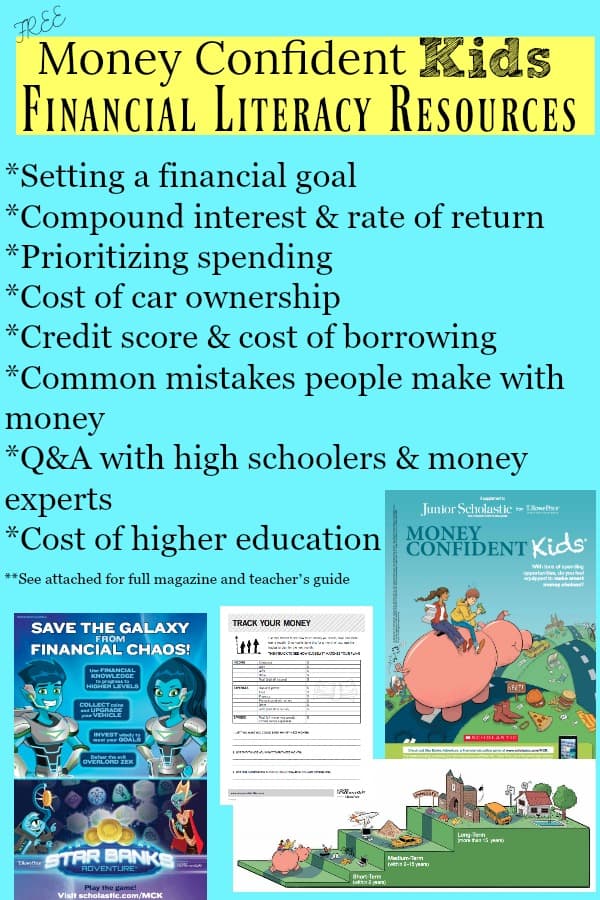

You guys know how much I LOVE free resources! T. Rowe Price has a website called Money Confident Kids which provides fantastic (free!) financial materials for grades 6-12. These free resources come in the form of two Student Magazines – developed with Scholastic – for Middle School and High School, and also includes games, stories, and activities. There’s a pretty cool & historic food prices article to track inflation as well that really gives kids insight on how money has changed over the years. You can even download a printable money tracking chart too! It’s worth it to spend a few minutes poking around and look for what resources you can incorporate with your students.

BUY it NOW! Today’s SALE! There are so many gimmicks, marketing advertisements, and enticing reasons to get everything right now before the price changes! But this can be incredibly tempting (and confusing!) for kids. Help kids see past this & must have now advertising and learn how to not make purchases based on impulse. I like to remind my kids to wait a day or two before putting money down on a purchase and then see if they really feel like they still need it.

Whether you have middle schoolers or high schoolers at home or in the classroom, below are some great tips on how to incorporate financial activities and learning. These pair perfectly with the free resources from Money Confident Kids®.

How to Incorporate Financial Activities in Your Classroom:

*Provide visuals for the students to look at and work with. Print the student magazine and teacher’s guide to pass out to students and pair in teams.

*Take a field trip to the store where students must complete a purchase with a goal by themselves.

*Create a classroom “store” with pretend money for students to earn, spend, and track purchases.

*Incorporate financial vocabulary words and scenarios into other subjects.

*Create scenarios for students to participate in where they must learn how to set out percentages of income for bills, investments, retirement, and fun.

*Brainstorm ideas of what to do after financial failure and where to find help if needed.

*Hand out weekly grocery ads and have students create a shopping list up to $20 (don’t forget tax!) that covers all basic food groups.

*Encourage your math students to multiply out the actual cost of debt and interest. Create scenarios for the students to “overspend” at various interest rates so they can see just how much extra overspending can really cost them.

Tips for Learning about Finances at Home:

*Kids learn by doing! Let them do their own shopping, curate grocery lists, etc. Teach them about brand vs. generic, how to read cost per ounce, use coupons, etc.

*Play financial games! It provides a great launching pad for discussions. The Star Banks Adventure® Game is a great start!

*Share with your kids when you made a financial failure as a kid and how you learned from it!

*Challenge your kids to earn money through jobs, chores, allowance, etc. and help them learn how to keep track of their income AND expenses during the summer.

*Take your child to the bank and set up a bank account for savings. If you have teenagers consider overseeing them with a credit card and checks to learn how the process of paying bills and balancing accounts works.

Get your FREE issue of Money Confident Kids® magazine here!

This is a sponsored conversation written by me on behalf of T.Rowe Price and Scholastic. The opinions and text are all mine. MONEY CONFIDENT KIDS is a a registered trademark of T. Rowe Price Group, Inc.

Is there a monthly magazine for kids to learn finances?